We recently asked several of our concrete comrades to share with us their thoughts on the industry as a whole and their segment of the decorative concrete industry in particular. Though their answers and experiences were wildly different, the one thing that clearly came through is an excitement for the nearly unlimited potential these experts see in the industry right now.

We asked everyone the same set of questions. It wasn’t easy to approach this, given our friends’ varied experiences and applications. Perhaps the first challenge to looking ahead this way is defining the industry in general.

“The basic question, ‘Where is our industry headed?’ is riddled with complexity, considering there is no common ground as to what our ‘industry’ is,” says Jeremy French, artisan with Buddy Rhodes Concrete Products. “Is it concrete? Is it countertops? Is it artisans? The perspective about the future depends heavily on which one of these definitions rings truest to the individual.”

Many factors have contributed to the growth of the industry. “The combination of better materials, better education and greater public awareness means demand is growing in all market segments,” French says. “This is what is great about concrete as a moldable material . . . it can be shaped to demand and has a unique problem-solving ability as a result. The better the artisan is at shaping the material, the more specifiers will resort to the material to solve design challenges, regardless of whether the environment is residential, commercial or public.”

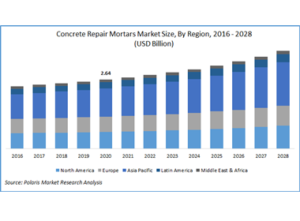

According to a report published by the Freedonia Group, ready-mix concrete will continue to be the fast-growing segment for cement through 2015, and will account for nearly 30 percent of global demand. Demand in the U.S. for precast concrete is expected to rise to $11.3 billion in 2015. This same report notes residential buildings are the fastest-growing segment for precast. Of all product types, architectural concrete will see the fastest-growing demand through 2015, thanks to decorative facades. A 2014 report from the Portland Cement Association predicts cement consumption will rise to 93.3 million tons in 2015 and 103.2 million tons in 2016.

What this rise in use means to us is perhaps best said by Cody Carpenter, owner and operator of Architectural Concrete Interiors. “Let’s put it this way, this ain’t Kansas anymore, Mr. Concrete!” he says. “I am excited for what our industry has in store, and see it going in a positive direction. Concrete embodies richness and this is something that will never lose its popularity as a design medium.”

Where is your segment of the decorative concrete industry at in relation to competing products, and do you see continued growth?

Grier: “One of the primary catalysts moving this segment of the decorative concrete industry forward is the nearly unlimited variety of finishes that can be achieved along with the ability for these coating systems to also be functional within a heavy-traffic environment.”

Scharich: “Decorative concrete is definitely stealing market share on the interior flooring market. Usage of dyes, stains and polishing in retail, education and industrial buildings has experienced tremendous growth in that same five-year period. Nonstamped color-usage options like sandblasting, swirl-finishing and artistic directional brooming combined with secondary colored borders are being utilized in greater numbers each year.”

Sacco: “I feel we will see continued growth in the decorative market.”

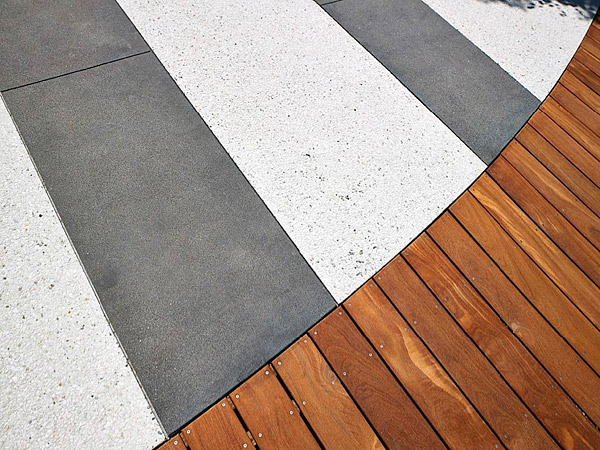

Sullivan: “Imprinted concrete has become a mainstream hardscape finish that is available in all markets and is offered by most residential concrete contractors. The paver industry has taken note of the stamped concrete industry and has come out with larger paver stones, textured surfaces and expanded color options. I think stamped concrete will grow, but it will mostly come from an expanding construction market as the economy grows, not from an expansion of the stamped concrete market itself taking market share from other hardscape surfaces.”

Koebrick: “The decorative concrete market segment is definitely growing at an exponential rate. We see it replacing vinyl tile, natural stone, ceramic tile and even wood as new products offer competitive design elements. Polished concrete is rapidly growing in retail and commercial, replacing vinyl tile and alternatives. However, last year there was a fast-growing trend in artesian style floors.”

Wilson: “Coatings have their strengths, especially when there’s a need to address a problem area or completely rehabilitate existing old, damaged or discolored flooring without removing or replacing the existing concrete. Polishing has taken the industry by storm, especially in new construction and commercial projects. Self-leveling overlays are a growth area for the industry.”

Underwood: “We are starting to see combination technologies that provide enhanced performance based on the strength of the application.”

Reardon: “Decorative concrete and/or finished concrete floors have grown by leaps and bounds in the last couple of years. We have seen explosive growth in the marketplace with dyed/stained concrete, integral colored concrete, overlays, integral colored overlays, along with the ‘naked’ floor. Traditionally we hear ‘the concrete is already there,’ the term canvas is being used more and more, and the ‘natural’ characteristics of the concrete as it sits are a bonus to their clients and no longer need to be covered up.”

What do you see as the main catalyst moving your segment of the decorative concrete industry forward: pigments, new products, chemical improvements, better training, public awareness, sustainability or something else? Or all of the above?

Scharich: “I believe concrete pigments are the core product that industry growth will be built around. The use and public awareness that comes with their high-visibility placement is the face of our industry.”

Sacco: “I am starting to see custom concrete countertop fabrication coming back strong. Vertical wall mix is gaining popular attention once again due to its ability to be sculpted to replicate many different natural items like stone, brick, tiles and even wood. Restoration work is also on the rise.”

Sullivan: “Plain and simple – innovation and customization must occur to keep stamped concrete relevant in the hardscape industry. Most of this will need to come from installers as they offer new and unique color options, creative design options and customization options for each job (for a price).”

Underwood: “Pigments. As color becomes increasingly more popular, new products that provide better uses of existing technologies and breakthrough technologies can change the game. However, all of these innovations will need better messaging and awareness to consumers and contractors if we are to continue to see growth in this industry.”

Koebrick: “New products, definitely. We are seeing a wave of new business coming from contractors who are fed up with products not performing as represented. The best way to move the industry forward is to have more performance-based specifications that force manufacturers to provide quality products.”

Wilson: “For the industry overall, public awareness, architect education, contractor training and product availability are key catalysts moving forward. Architects and designers need more education on the differences between various coatings so they can properly specify them. Product training is always key, but sometimes the contractors need more training on how to sell the products rather than just how to apply them. Unfortunately too many contractors are either good at selling or good at applying coatings, but not both.”

Reardon: “As the industry matures we have been lucky to be part of a new generation of products, services and manufacturers becoming more entrenched with the customers they serve and the industry as a whole. In picking the main catalysts that have driven this I would say training by manufacturers, new chemical technology and advancement in tooling and planetary grinders.”

Where do you see the greatest increase in business coming from: retail, industrial, residential, private sector, municipalities or somewhere else?

Grier: “The largest increase in business over the next 10 years will be from the commercial and industrial sector. Companies are just now becoming aware of the advantages offered by high-performance systems which limit downtime.”

Scharich: “Following the economic stimulus in 2008, the municipal decorative concrete market saw huge growth. But those funds have run out and the burden is back on the local communities. Because of this, I expect to see the retail market as the area where our biggest growth will come from.”

Sacco: “On the decorative side, most of my increase in business has been in new product formulation and/or manufacturing capacity.”

Sullivan: “Mostly from private sector/residential and some from municipalities.”

Underwood: “I believe retail offers the biggest opportunity for growth, as awareness increases and products become increasingly easier to use.”

Koebrick: “We see growth in all segments across the board equally. However, our significant growth has come from new product options specifically addressing needs within each segment.”

Wilson: “Retrofits and renovations, regardless of whether it’s for the residential, commercial, industrial or municipal segments, will always be our biggest market, but I see a lot of opportunities in the industrial segment.”

Reardon: “As we mature we are seeing all aspects of industrial, retail, residential, doctor offices, homes, schools, etc. using decorative concrete. Growth will come and along with that an increase for training, training and more training.”

Carpenter: “I have seen a much larger spectrum of clients in recent years. Precast concrete, when put into the hands of the artisans in our industry, will continue to gain momentum because of the amount of talent that is producing it. We are fueled by some of the world’s most talented designers that are guided by the medium of concrete which translates itself into beauty.”

What are some negatives trending in your segment of the industry?

French: “If the value of artisan concrete is not maintained, it will be difficult for the material and the artisan to fully realize the potential. The companies that undercut on price go out of business, but they wreck perceived value in the process. The effort it takes to rebuild that perception is significant, and it makes for unnecessary complications for those trying to build sustainable businesses using artisan concrete.”

Scharich: “The decorative concrete market will always suffer some from untrained or unskilled installers. Tremendous effort exhibited toward project sales can be destroyed by a price-based, low-quality contractor.”

Sacco: “I am not sure if we have negative trends in our segment of the industry. What I can see is that with the small amount of residential work that is on the rebound, most property owners are still cash-strapped and are forced to cut out upgraded items like pattern-stamped walkways, patios and driveways.”

Sullivan: “Quality of work remains the major negative trend.”

Underwood: “Failures usually occur due to a lack of proper preparation to the substrate, which is usually a result of the lack of knowledge of the person applying the solution. Availability of more training tools and demonstrations are critical to ensure the average end-user has enough tools in their toolkit to ensure success.”

Koebrick: “The biggest negative we foresee is the onslaught of unproven and untested systems on the market and the lack of performance-based specifications.”

Wilson: “There have been changes to chemical usage guidelines and product VOC guidelines. Finding replacement chemicals that do not impact the workability or performance of the product is key and can be a challenge. Also, we are seeing companies in many foreign countries developing their own products and producing them locally, so the export market for U.S. companies is decreasing.”

Carpenter: “We find ourselves still chasing that perfect durable finish that meets industry solid-surface expectations of a low-maintenance, durable product similar to quartz countertops. We as an industry are still struggling to match large manufacturers’ finishes similar to GFRC concrete without the maintenance drawbacks of concrete. Where concrete will and always has shined is in its ability to morph into endless shapes and surface finishes, which has always given us an edge in certain design applications.”

Reardon: “We need to look back on the way natural stone floors were polished. Our industry faces the same task as other industries, like it and unlike it. We need to stick to basics and still perform the traditional methods that existed in the beginning. With the advancements come responsibility of the industry, the applicators and everyone involved. We need to protect the basics while still providing progress forward.”

The following people contributed to this story:

Cody Carpenter, owner and operator of Architectural Concrete Interiors; specialty is countertops and precast

Jeremy French, artisan with Buddy Rhodes Concrete Products; specialty is countertops and precast

Ben Grier, with sales and marketing for HP Spartacote; specialty is concrete coatings/epoxies/sealers

Jeff Koebrick, president of Convergent Concrete Technologies LLC; specialty is polished concrete flooring

Joe Reardon, director of SASE Signature Floor Systems; specialty is polished concrete flooring

Bart Sacco, owner of Kingdom Products; specialty is stamped and imprinted concrete

Todd Scharich, owner of Decorative Concrete Resources; decorative concrete specialist with the American Society of Concrete Contractors

Chris Sullivan, vice president of sales and marketing for ChemSystems Inc.; specialty is concrete coatings, epoxies and sealers

Chris Underwood, product manager of H&C, Diversified Brands, for Sherwin Williams; specialty is concrete coatings, epoxies and sealers

Jennifer Wilson, brand manager for Rhino Linings Corp.; specialty is concrete coatings, epoxies and sealers